What to Know When Selling Gold and Silver

When our customers come in to sell their precious metals we employ various methods to evaluate quality and price. Many factors are considered in evaluating gold, silver and platinum, such as, the karat (purity), weight, form ( ie. jewelry, coins, scrap, bullion) and the market price and volatility.

Purity- Measured in Karats

Karat’s (K or Kt) is the measure of gold’s purity by mass. 24 K gold is considered as 99.9% pure. Jewelry is most commonly seen in the form of 10k, 14k or 18k, with other base metals making up the remainder. Pure gold is very soft, so the addition of base metals increases the durability of jewelry. After determining the purity of the metal, we adjust the Karat amount from the “spot” or current market price of gold.

Silver is typically found in either .999 fine or .925 sterling. Most jewelry or flatware is sterling silver and marked as either sterling or 925.

In the event that a seller possesses gold or silver that is not stamped with either a Karat weight or percentage number, our metal analysts move to the next level of evaluation, acid testing.

Acid Testing

Precious metals can be evaluated for purity by testing their response to various acids. The metal is rubbed on a stone or rough glass flat surface to remove small particles. Different strength acids are then applied to the gold or silver particles to determine the purity or if the purity mark is indeed accurate. Some jewelry may be marked 14k but test as a stronger or weaker purity. The metals reaction in both color and time will determine the purity. If the metal tests strong with one acid, then a higher level acid will be applied to further test purity.

Weight

All precious metals are weighed on our digital scales in either grams (g) and/or pennyweights (dwt). After being weighed and tested for purity, the total weight is multiplied by the market rate of the precious metal as adjusted for purity.

Form

The form of the gold, silver or platinum impacts the price in which buyers can offer in payment. Some precious metals can bring a higher price if they are in more desirable forms and conditions.

Jewelry

Broken jewelry and most used jewelry is usually scrapped and sent to a refiner. Fine pieces of jewelry may bring a premium if it can be sold in the retail market or used in new designs.

Broken jewelry and most used jewelry is usually scrapped and sent to a refiner. Fine pieces of jewelry may bring a premium if it can be sold in the retail market or used in new designs.

Coins

Gold and silver coins are typically high in purity and are generally accepted as such by most markets. Coins are bought at a premium over broken or scrap jewelry and can even be valued higher than the spot price of the precious metal itself. When a coin has a higher value than its metal and is considered collectible, it is said to have numismatic value. Numismatic value is determined by the desirability and rarity of the coin. If a gold or silver coin does not have a collectors premium it is sometimes referred to as bullion or “junk”. Bullion or U.S. 90% “junk silver” is still highly sought after and valuable, however it generally does not command a premium over the market value.

Gold and silver coins are typically high in purity and are generally accepted as such by most markets. Coins are bought at a premium over broken or scrap jewelry and can even be valued higher than the spot price of the precious metal itself. When a coin has a higher value than its metal and is considered collectible, it is said to have numismatic value. Numismatic value is determined by the desirability and rarity of the coin. If a gold or silver coin does not have a collectors premium it is sometimes referred to as bullion or “junk”. Bullion or U.S. 90% “junk silver” is still highly sought after and valuable, however it generally does not command a premium over the market value.

Market Conditions

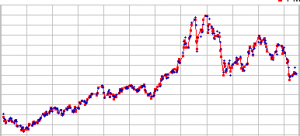

The precious metals market can be extremely volatile and is constantly changing. The price the seller can expect will always depend on the current market rates when the buyer evaluates the metal. If the gold and silver buyer is buying an item like jewelry, then they are required to hold the item(s) for up to 30 days before being able to sell it to a refiner. Market volatility must be assessed when making a purchase.

The precious metals market can be extremely volatile and is constantly changing. The price the seller can expect will always depend on the current market rates when the buyer evaluates the metal. If the gold and silver buyer is buying an item like jewelry, then they are required to hold the item(s) for up to 30 days before being able to sell it to a refiner. Market volatility must be assessed when making a purchase.

Our Baton Rouge Store

Gold and Silver of Louisiana is a precious metal buyer in Baton Rouge that specializes in providing the very best service and environment for those looking to sell their gold, silver or platinum.